A deferred annuity would better be defined as a category of annuities rather than a type of annuity. All annuities can be categorized as either deferred or immediate. When income payments are scheduled to begin is the determining factor as to which category an annuity belongs. There are many different types of annuities that fall underneath the broader deferred annuity category.

A deferred annuity has two phases: the accumulation phase, where you let your money grow for a period of time, and the payout phase. During accumulation, your money grows tax-deferred until you withdraw it, either as a lump sum or as a series of payments. You decide when to take income from your annuity and therefore, when to pay any taxes owed. Gaining increased control over your taxes is one of the key benefits of deferred annuities.

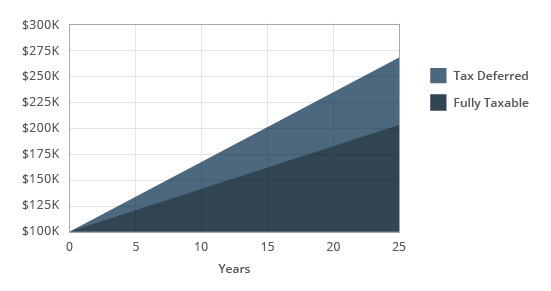

The longer you can defer paying income tax on your compounded interest earnings, the greater your gain will be as compared to the gain you would make with a fully taxable account, such as a bank certificate of deposit (CD) or money market account.

The Tax-Deferred Advantage

To illustrate the increased earnings capacity of tax-deferred interest, compare it to fully-taxable earnings. $100,000 at 4.0% will earn $4,000 of interest in a year. A 28% tax bracket means that approximately $1,120 of those earnings will be lost in taxes, leaving only $2,880 to compound the next year. If these same earnings were tax-deferred, the full $4,000 would be available to earn even more interest in the coming years. The longer you can postpone taxes, the greater the impact tax-deferral will have on your overall accumulated interest earnings.

As you can see from the example above, after 25 years, the tax-deferred account has an ending balance that is $63,220 greater than the fully taxable account.

Payout Phase

The payout phase begins when you decide to take income from your annuity. For most people, this is during retirement. As your needs dictate, you can take partial withdrawals, completely cash-out (surrender) your annuity, or convert your deferred annuity into a stream of guaranteed income payments (annuitization). This last option is essentially the same as buying an immediate annuity and will occur automatically on the maturity date of the contract if no action is taken in advance of that date.

Maturity Date

Many people confuse the contracts maturity date with the length of the guarantee period or surrender penalty term. The maturity date is the date specified within the annuity contract at which time the owner must elect a settlement option and begin receiving payments by way of annuitizing the contract. This occurs at a predefined attained age, typically somewhere between the ages of 95 – 115. Whereas the guarantee period or surrender penalty term is the timeframe in which the contract is still subject to penalties for early surrender or withdrawals exceeding the penalty free provisions of the contract, commonly 3 – 10 years from the initial contract issue date.

Safety

Fixed tax-deferred annuities are safe. They are issued by qualified legal reserve life insurance companies which are heavily regulated and required to meet contractual obligations to all policyholders. Legal reserve refers to the strict financial requirements that must be met by an insurance company to protect the money paid in by policyholders. These reserves must be at all times, equal to the withdrawal value (principal plus interest less early withdrawal fees, if any) of every annuity policy that the company has issued. State insurance laws also require that a life insurance company must maintain certain minimum levels of capital and surplus, which provide additional policyholder protection.